Congress passed legislation, which President Obama

indicated he would sign, to avoid the fiscal cliff.

The legislation would allow tax rates to rise on the

nation's highest earners while also extending dozens of tax cuts for individuals

and businesses. Specifically, the bill:

•

Raises the top tax rate to 39.6% for married couples earning $450,000;

head of household earning $425,000; single taxpayers earning $400,000. These

amounts will be indexed for inflation.

•

Raises long-term capital gains and qualifying dividends tax rate to 20%

(from 15%) for taxpayers in the 39.6% tax bracket for regular and alternative

minimum tax.

•

Permanently extends Bush-era tax cuts from 2001 and 2003 for all other

taxpayers.

•

Reinstates phase-out of personal exemptions and overall limitation on

itemized deductions for married couples filing jointly earning over $300,000 and

single taxpayers earning over $250,000.

•

Raises the maximum estate tax rate to 40% but keeps the exemption amount

at $5 million, adjusted for inflation.

•

Extends for 5 years (through 2018) the American Opportunity Tax Credit to

pay for higher education, and special relief for families with 3 or more

children for the refundable portion of the child tax credit and increased

percentage for the earned income tax credit.

•

Patches the AMT for 2012 and adjusts the exemption amount for inflation

going forward.

•

Extends through 2013 the following individual tax benefits: above the

line deduction for teacher expenses, relief from cancellation of debt income for

principal residences, parity for employer-provided mass transit benefits,

deduction for mortgage insurance premiums as interest, election to deduct state

and local sales taxes in lieu of income taxes, above the line deduction for

qualified education expenses, tax-free distributions from IRA accounts for

charitable purposes.

•

Extends through 2013 certain business tax provisions that expired at the

end of 2011 including: the research credit, the new markets tax credit, railroad

track maintenance credit, mine rescue team training credit, work opportunity

credit, the Section 179 asset expensing at $500,000, Section 1202 stock

exclusion at 100%, and empowerment zone incentives.

•

Extends 50% bonus depreciation through 2013.

•

Extends through 2013 certain energy tax incentives that expired at the

end of 2011 including: energy efficient credit for existing homes, alternative

fuel vehicle refueling property credit, biodiesel and renewable diesel

incentives, wind credit, energy efficient credit for new homes, and credit for

manufacture of energy efficient appliances.

Unfortunately, the legislation does little to address

spending by the federal government!

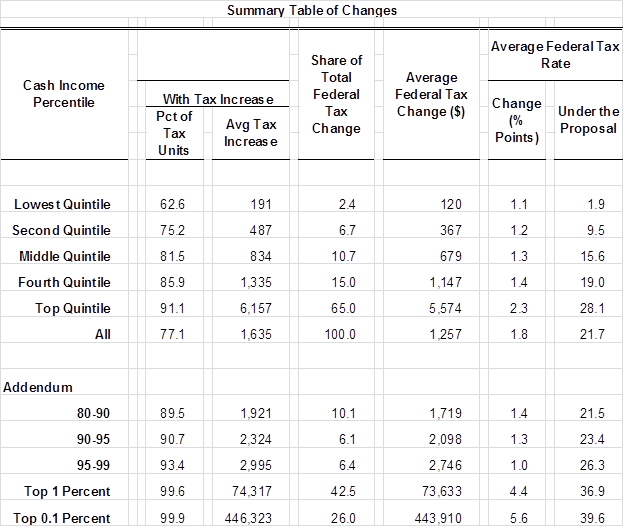

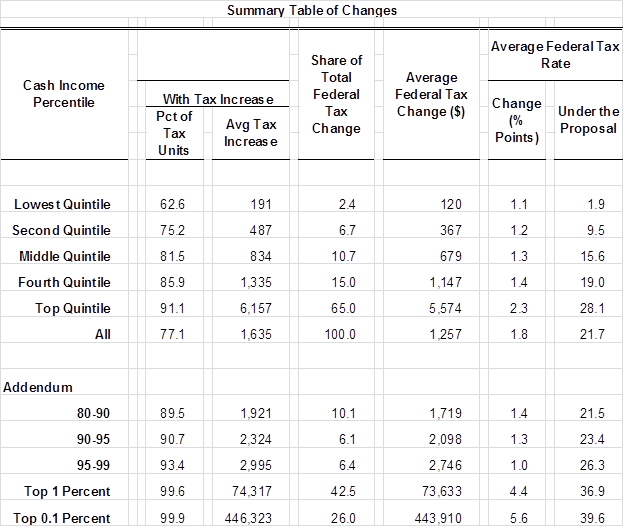

Based on additional tax of 3.8% imposed by Obamacare on

high-income earners and return to former withholding rates, all taxpayers will

be impacted as the following chart indicates.

Note:

The Addendum breaks down the Top Quintile further.